Online ONLY Banks

HSBC, a bank I once had an account with in NY and was happy with, doesn't have many branches in the bay area. But they have started an online-only bank that features a robust money market account. You can mail payments, transfer funds from other accounts, pay bills online, have an ATM/Debit card, and do all of the rest.

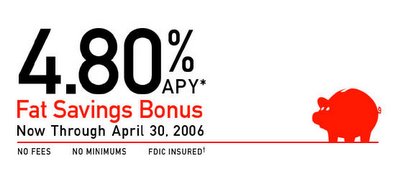

The best part is the HSBC is offering an introductory 4.80% annual percentage yield rate through this April, at which point it'll drop down to 4.25%. Even at the latter rate, this rate is astronomical compared to comparable banks. Citibank--which I currently have--is terrible in this regard. With its pitiful so-called "Super Yield" money market accounts, Citibank offers the following rates:

• Under $9,999: 1.01% APY, 1.00% Interest Rate

• $10,000 to $24,999: 1.50% APY, 1.49% Interest Rate

• $25,000 to $49,999: 1.90% APY, 1.88% Interest Rate

• $50,000 & over: 2.25% APY, 2.23% Interest Rate

Compare these to the rate HSBC offers for a minimum balance of just $1.00. It's pitiful. The drawback with an online only bank is that it's hard to get cash fast if you don't have an HSBC branch or ATM near you. But for the younger generation of purchasers, an online only bank is perfectly fine. Also, there are a number of ways to deal with common issues:

- Paychecks -- most of us can set up direct deposit, so you never have to go to the bank anyway. Or, if you don't have direct deposit available, you can mail it directly to the HSBC facility.

- Everyday Purchases -- you can use the included ATM/Debit card OR, and I think this is much better, put everything you buy on a credit card that offers rewards points and just pay the balance at the end of the month. Then all you do is use the 'online bill pay' feature of your bank account and pay off one big bill a month.

- Monthly Bills -- same as your everyday purchases. Put your cell phone, internet, TV, electricity, insurance, and everything else on your CREDIT CARD, then pay the card's bill off at the end of the month. You'll get free rewards for doing nothing.

- Cash -- if you don't have an ATM near you, keep a free local checking account or just ask for cashback during a purchase.

So if you're someone that's just looking to make a little more interest on your savings, or you're not sure about investing in the market, an FDIC insured money market account can help generate maybe few hundred dollars each month, which might actually take care of your cell phone, TV, and other bills.

No comments:

Post a Comment